Stablecoins are steadily moving from just a side piece of the cryptocurrency ecosystem into the mainstream, capturing the attention of users and brands across the globe.

As they migrate rapidly from the position of “early adopters” to the “early majority,” a new wave of infrastructure optimized for payments, not just wallets, is the key to unlocking their true potential.

Stablecoins are not only reshaping the future of digital payments but also addressing long-standing inefficiencies in the global financial system, particularly in regions like Africa. In this context, BoundlessPay is positioning itself as a bridge to this future, leveraging stablecoins to facilitate seamless cross-border payments.

What Makes Stablecoins So Powerful?

Stablecoins (digital currencies pegged to fiat currencies like the US dollar or euro) are designed to provide the stability of traditional money while retaining the efficiencies of blockchain technology. Here’s why they’re proving to be a game-changer:

- Price Stability: Unlike volatile cryptocurrencies such as Bitcoin or Ethereum, stablecoins maintain a stable value. This makes them ideal for everyday transactions and savings, eliminating concerns about fluctuations eroding value.

- Borderless Transactions: Stablecoins enable frictionless cross-border transactions. Traditional banking systems often impose high fees and lengthy processing times for international transfers, but stablecoins settle payments almost instantly, with minimal cost.

- Financial Inclusion: In regions where access to banking infrastructure is limited, stablecoins provide a lifeline. People without bank accounts can send, receive, and save money using stablecoins via mobile devices, significantly enhancing financial inclusion in underbanked areas like many parts of Africa.

- Transparency and Security: Built on blockchain technology, stablecoins offer unparalleled transparency. Transactions can be verified publicly, fostering trust. Additionally, their decentralized nature ensures that funds remain secure without reliance on traditional banking intermediaries.

- Programmability: Stablecoins are programmable, allowing businesses to automate complex financial processes like payroll, invoicing, and recurring payments. This efficiency is particularly advantageous for businesses operating in a global economy.

The Shift from Wallets to Payments

The first generation of stablecoin infrastructure was wallet-centric, designed for holding funds rather than moving them. While these solutions were sufficient for early adopters, they fall short of the growing wave of users who see payments as the primary use case. As Stripe’s co-founder recently put it, stablecoins are like “room-temperature superconductors for financial services,” making payments incredibly efficient.

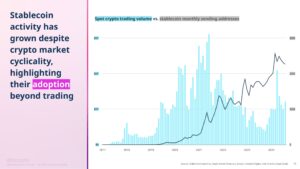

Stablecoins are not just a passing trend. If you examine stablecoin activities against crypto’s volatile market cycles, the two appear to be uncorrelated. Even while spot crypto trade volumes fell, the number of monthly stablecoin-sending addresses has increased. In other words, it appears that stablecoins are being used for purposes other than crypto trading.

To support this demand, the next generation of infrastructure must focus on scale. It’s no longer just about storing digital currencies, it’s about enabling rapid, cost-effective, and reliable transactions across borders. This evolution marks a pivotal moment for stablecoins, with payments emerging as their “killer use case.”

Stablecoins in Africa: Unlocking New Opportunities

Africa presents a unique case for stablecoin adoption due to its financial challenges. High remittance fees, currency instability, and limited access to banking infrastructure have left many underserved. Stablecoins address these pain points by:

- Reducing Remittance Costs: With remittance fees in Africa averaging over 7%, stablecoins offer a far cheaper alternative, enabling people to send money across borders with near-zero fees.

- Hedging Against Currency Instability: Many African nations face significant currency volatility. Stablecoins pegged to stronger fiat currencies provide a reliable store of value, shielding users from inflation and economic instability.

- Facilitating Trade: Africa’s informal trade sector, which relies heavily on cash transactions, can benefit from stablecoins’ digital nature, making trade faster, safer, and more efficient.

How BoundlessPay Is Driving Stablecoin Adoption

BoundlessPay is at the forefront of the stablecoin revolution, providing infrastructure optimised for payments at scale. With its mission to bridge the gap between traditional finance and blockchain technology, BoundlessPay has integrated stablecoins as a pillar of its platform. Here’s how:

- Cross-Border Payments Made Simple: BoundlessPay leverages stablecoins to enable seamless cross-border payments. Users can send and receive funds instantly, avoiding the lengthy delays and high fees of traditional remittance systems. This service is particularly valuable for African users conducting trade, remittances, or international transactions.

- Multi-Currency Support: BoundlessPay supports a wide range of stablecoins that can be instantly converted to various fiat currencies, giving users the flexibility to transact in currencies of their choice. This is especially beneficial in Africa, where currency exchange often incurs high costs.

- Rewards and Incentives: By transacting with stablecoins on BoundlessPay, users earn rewards in the form of BPAY, the platform’s native utility token. These rewards incentivise usage while fostering greater adoption of both stablecoins and the BoundlessPay ecosystem.

- Simplifying On-Ramping and Off-Ramping: BoundlessPay makes it easy to convert between stablecoins and local fiat currencies, bridging the gap between the digital and traditional financial worlds. This feature ensures that users can easily access their funds in the form they need.

- Business-Friendly Solutions: For businesses, BoundlessPay offers solutions like payroll services, invoicing, and merchant gateways, all powered by stablecoins. This empowers businesses to operate more efficiently and tap into the global market.

The Road Ahead

Stablecoins are no longer a niche product for cryptocurrency enthusiasts, they are rapidly becoming a cornerstone of the global financial system. Their ability to provide stability, efficiency, and inclusivity makes them particularly well-suited for Africa, where financial challenges persist. BoundlessPay’s focus on integrating stablecoins into its platform aligns perfectly with this vision, offering a robust solution for cross-border payments and beyond.

As stablecoins continue to gain traction, the need for infrastructure optimised for payments at scale becomes increasingly urgent. With BoundlessPay leading the charge, the future of stablecoins in Africa, and the world—looks boundless.